What is the FinCEN BOI Report?

FinCEN mandates that many small businesses are required to file a Beneficial Ownership Information Report under CTA (Corporate Transparency Act) about the individuals who own or control the company. This act is effective from January 1,2024. BOI Reporting helps FinCEN to know more about the criminal activities of Beneficial owners.

Click here to learn more about BOI Reporting Requirements.

filectaboi.com - A Best Solution to File BOI Reports Online

In order to help Small Businesses, filectaboi.com supports e-filing BOI reports with FinCEN. When Filing BOI Reports with our software, you can take leverage these

features to

simplify your BOI filing:

Easy & Secure Filing

Use our cloud-based software to Submit your BOI Reports with FinCEN easily

from anywhere. Also, you can access your report at

any

time.

Support Initial, Correction & updates

Filectaboi streamline the BOI reporting. We Support filing of Initial Report, Correct & update the prior report.

Free BOI Corrections

You can submit a corrected or updated report for free within 7 days from the

date the initial BOIR was accepted

by FinCEN.

Instant Status Updates

Get instant updates on your BOIR. Our software will update you on the status

of your BOI filing through email or you can track the status from

the dashboard.

Pro Features that Simplify your BOI Filing

Staff Management

Streamline your tax filing, by inviting and managing your staff member, you

can easily assign roles, control access and

assign tasks.

Client Management

Easily manage client activities and securely communicate, sharing sensitive information

through our secure portal for streamlined

client

management.

Automated Reports

Get valuable insights on your staff performance and filing status tailored to your

business or clients, enhancing

decision-making.

Visit https://www.taxbandits.com/fincen-boi/efile-boi-report-online/

to learn more about

the features offered to simplify your BOI

Filing.

How to File BOI Report Online for 2024?

Filing your BOI Report is easier than ever before with filectaboi.com! Follow these simple steps to complete your reporting:

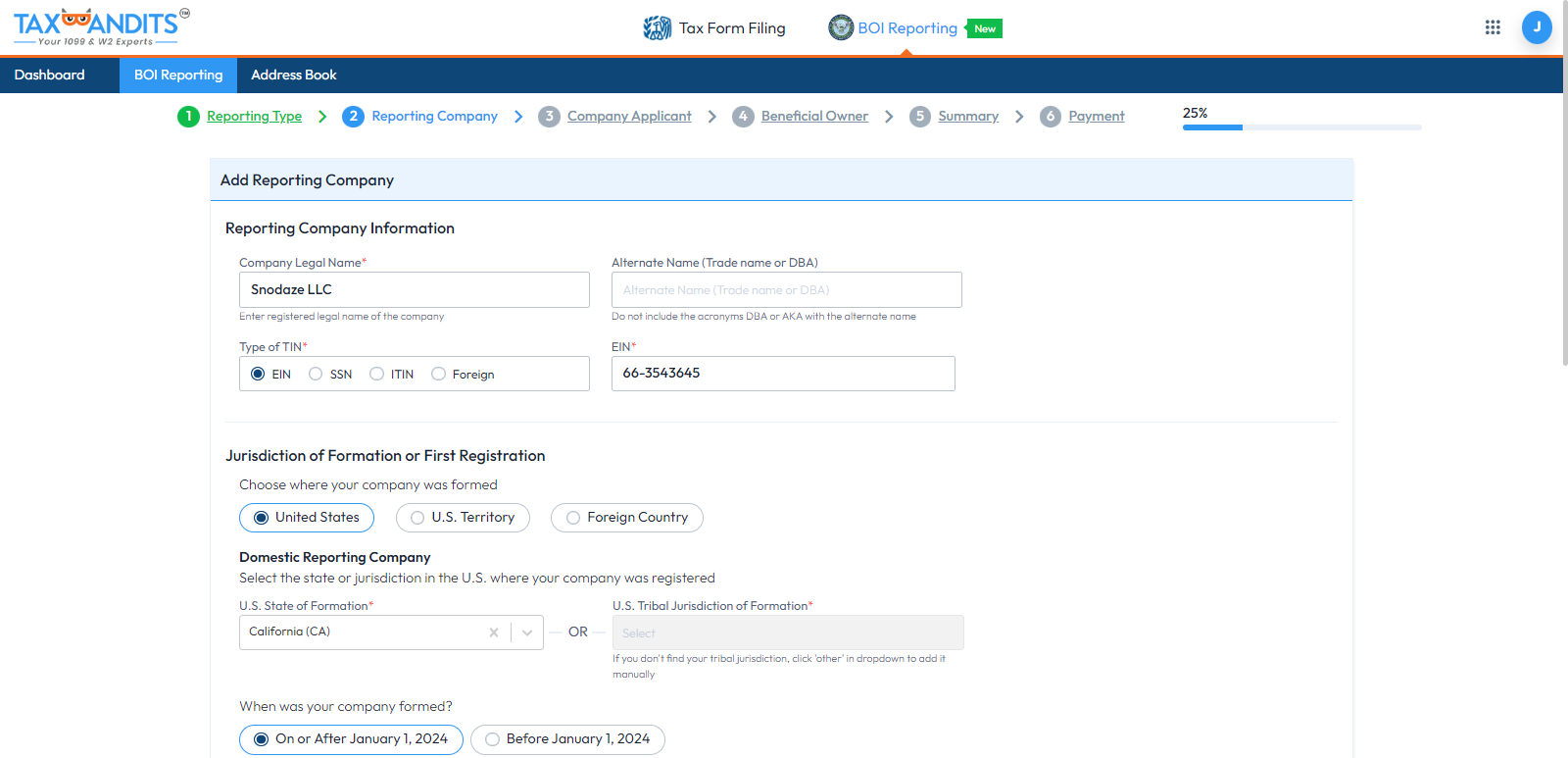

Step 1: Add Reporting Company Information

Enter the Reporting Company details, including Business Name, Tax Identification Number (TIN), and Jurisdictions.

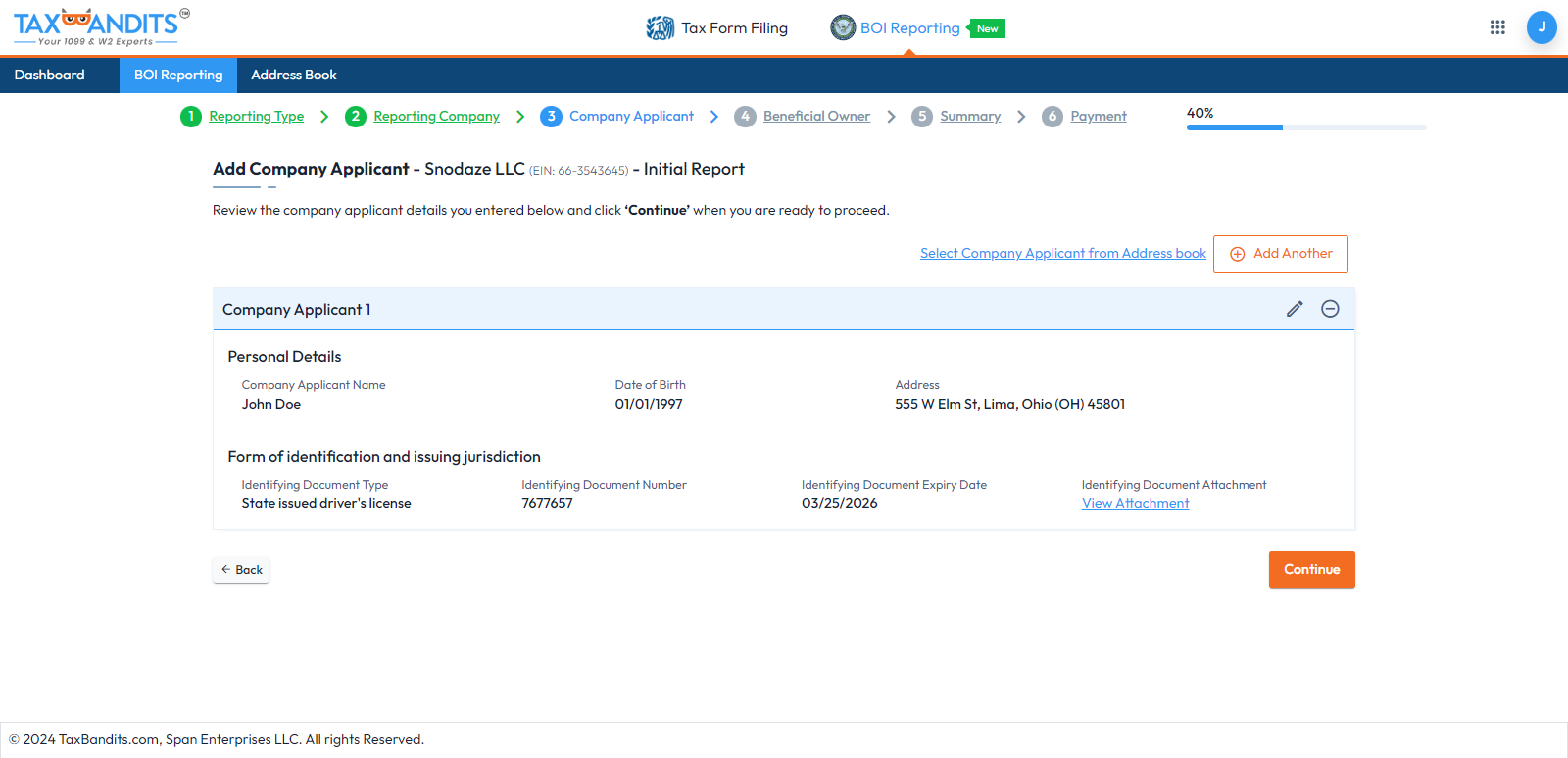

Step 2: Add Company Applicant Information

Fill in the applicant details, such as name, date of birth, and identity proof.

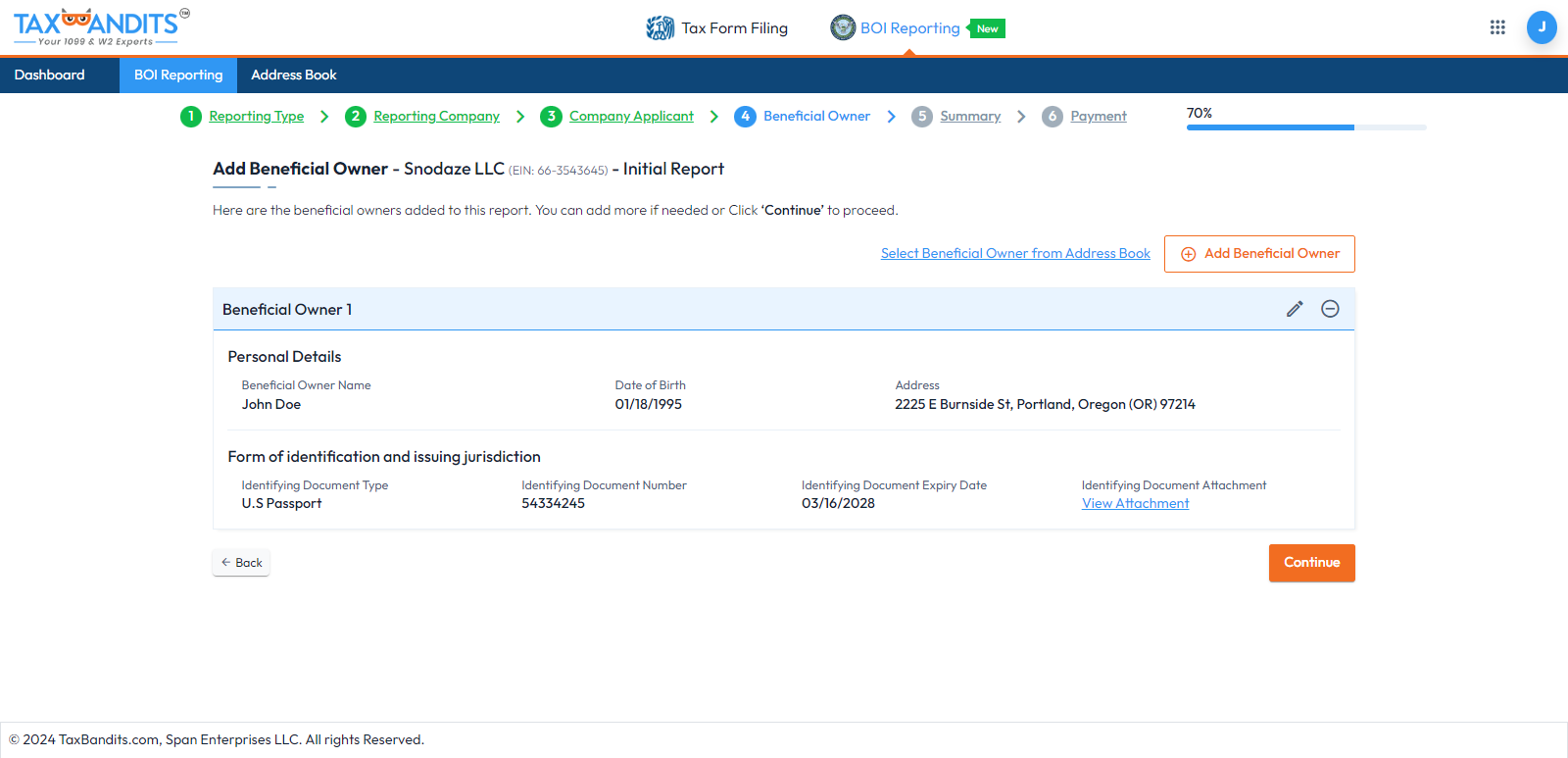

Step 3: Add the Beneficial owner Information

Enter Beneficial Owner information, including Name,

Date of Birth, Address, and

Identity Proof

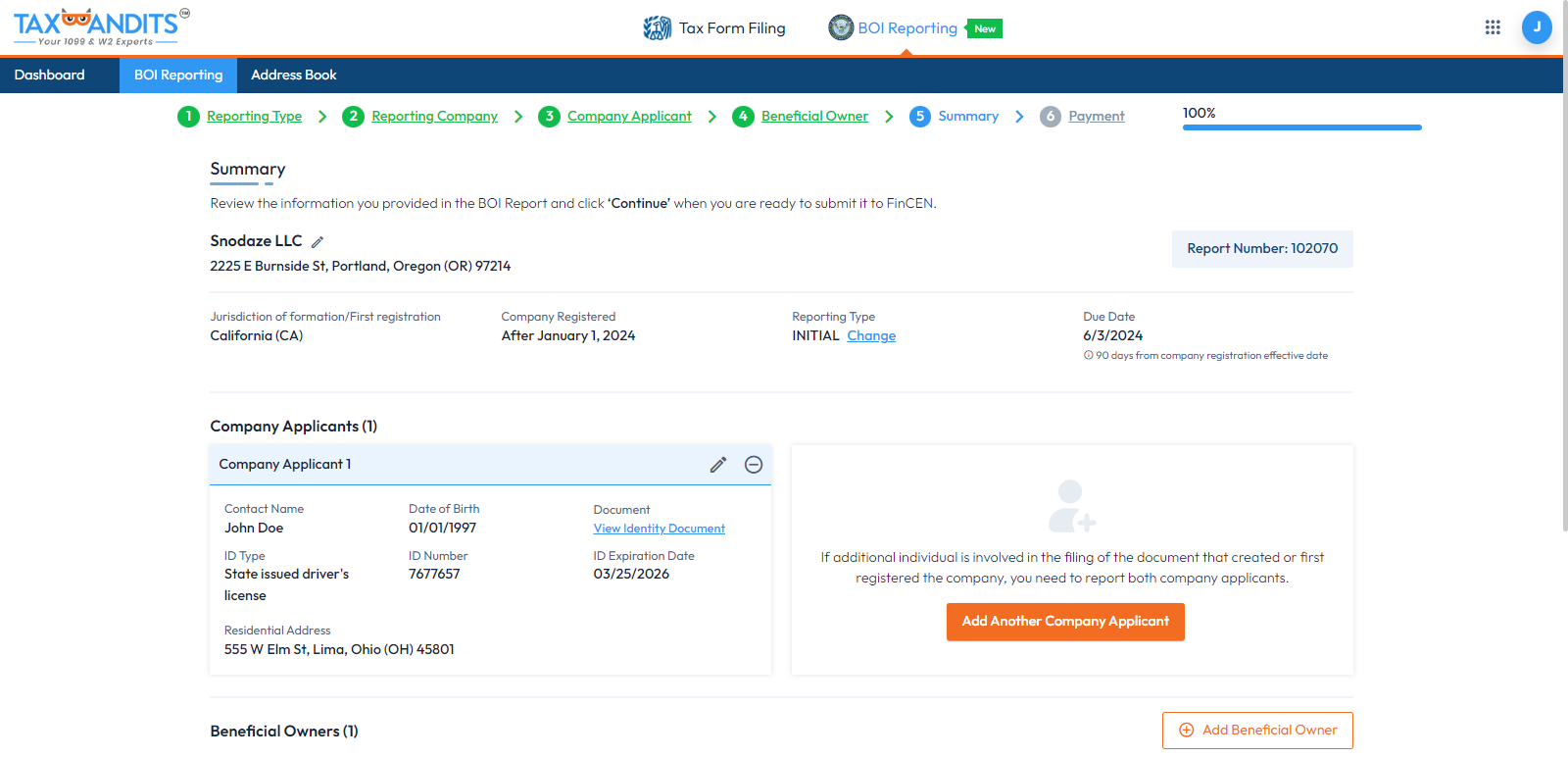

Step 4: Review and Submit to FinCEN

Review the entered information thoroughly and submit

the report

to FinCEN.

What information is required to File

BOI

Report Online?

The following information is

required to

complete your BOI Report :

- Type of the report (Initial, Update, Correct or Newly Exempt Entity)

- Reporting company: Name, EIN, Address, etc.

- Details of the Company Applicant(s): Name, Date of Birth, Address and Identity Proof

-

Beneficial Owners Information: Name, Date of Birth, Address and

Identity Proof

What information is required to File BOI

Report Online?

The following information is required to complete your BOI Report :

- Type of the report (Initial, Update, Correct or Newly Exempt Entity)

- Reporting company: Name, EIN, Address, etc.

-

Details of the Company Applicant(s): Name, Date of Birth, Address

and

Identity Proof -

Beneficial Owners Information: Name, Date of Birth, Address and

Identity Proof

When is the Deadline to File

BOI Report?

The deadline for submitting initial report varies based on when the entity was created.

For company is created on or after January 1, 2024,

the due date to submit the initial BOI report is within 90 calendar days of the

date the entity

is

created.

For company was formed before January 1, 2024, the due date for the initial BOI report submitting is January 1, 2025.

Frequently Asked Questions on BOI Report

Who is required to File BOI?

The following entities must file a Beneficial Ownership Information (BOI) report:

Domestic reporting company - A corporation, LLC, or other business entity formed by filing a registration document with a secretary of state (or similar) agency under the laws of a state or Indian tribe.

Foreign reporting company - A corporation, LLC, or other entity incorporated under the laws of a foreign country that has filed a document with a secretary of state or similar authority to register to do business in any US state or tribal jurisdiction.

Who is a beneficial owner of a reporting company?

Any person who, directly or indirectly, has substantial control over a reporting company or owns or controls at least 25 % of the reporting company's ownership interests is referred to as a beneficial owner of a reporting company.

Who is a company applicant for a reporting company?

The person who directly submitted the registration document for the company or, in the case of a foreign reporting company, the initial registration document authorizing the corporation to conduct business in the United States.

The person who has primary responsibility for overseeing or managing another

person's submission of the

relevant

document.

Are there any penalties associated with BOI Reports?

The Corporate Transparency Act's FinCEN rule stipulates that

noncompliance with

the BOI reporting requirements may result in civil penalties of up to $500 per

day. In addition, there is a $10,000 maximum fine and a maximum two-year prison

sentence for

criminal offenses.